student loan debt relief tax credit for tax year 2020

Borrowers can opt out of the program. Who may apply.

California Could Become First State To Tax Biden S Student Loan Forgiveness Will More Follow Gobankingrates

Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their.

Will have maintained residency within the state of Maryland for the 2020 tax year Have. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give. Were eligible for in-state tuition. The 5250 that employees are permitted to receive tax-free for their education under Sec.

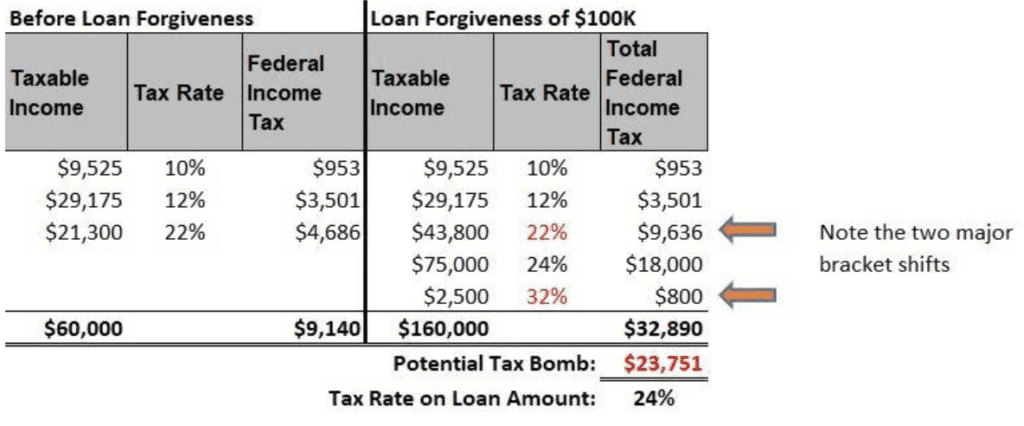

127 can also be used in 2020 for student loan repayment. As an example Rossman shows how federal student loan forgiveness of 10000 would have traditionally been taxed prior to Bidens tax update. You must claim Maryland residency for the 2022 tax year.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application.

Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000. Complete the Student Loan Debt Relief Tax Credit application. Under Maryland law the recipient.

If the credit is more than the taxes you would otherwise owe you will receive a tax. The Maryland Higher Education Commissionmay request additional. Under President Bidens student loan debt cancellation plan the Department of Education will provide student loan relief up to 10000 to borrowers whose loans are held by.

The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. How much money is the Maryland Student Loan Debt Relief Tax Credit.

Instructions are at the end of this application. For Maryland Residents or Part-year Residents Tax Year 2020 Only. This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

There isnt a set amount thats released for the. In Indiana for example the state tax rate is 323. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Say as a federal student loan. The funds must be applied to the. Now privately held federal student loans must have been consolidated before September 29 in order to be eligible for the debt relief.

Tax Year 2022 Only Instructions.

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

Who Qualifies For Biden S Student Loan Forgiveness Plan And What Else To Know The Washington Post

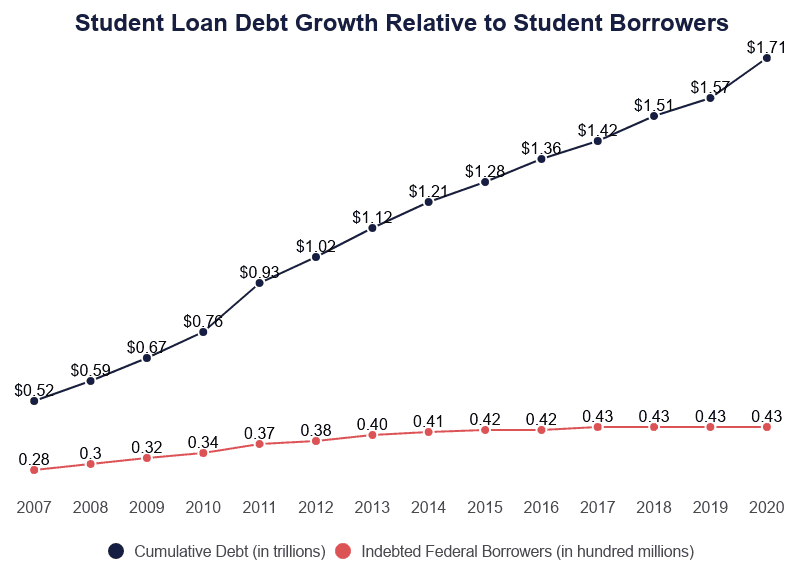

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Student Loan Debt Forgiveness Faq Who Gets Relief How Much Is Canceled And When Will It Happen Cnet

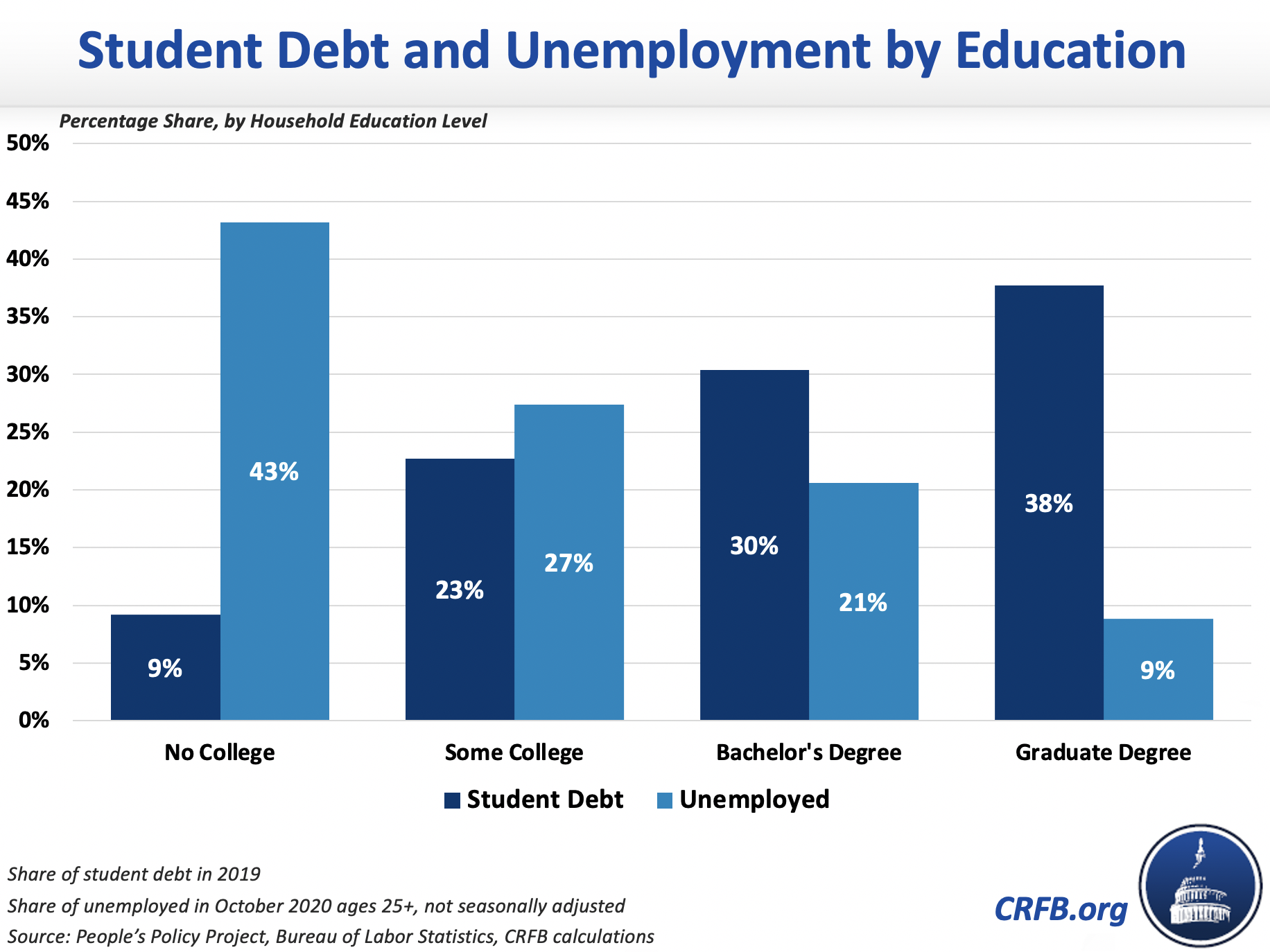

Who Owes The Most Student Loan Debt

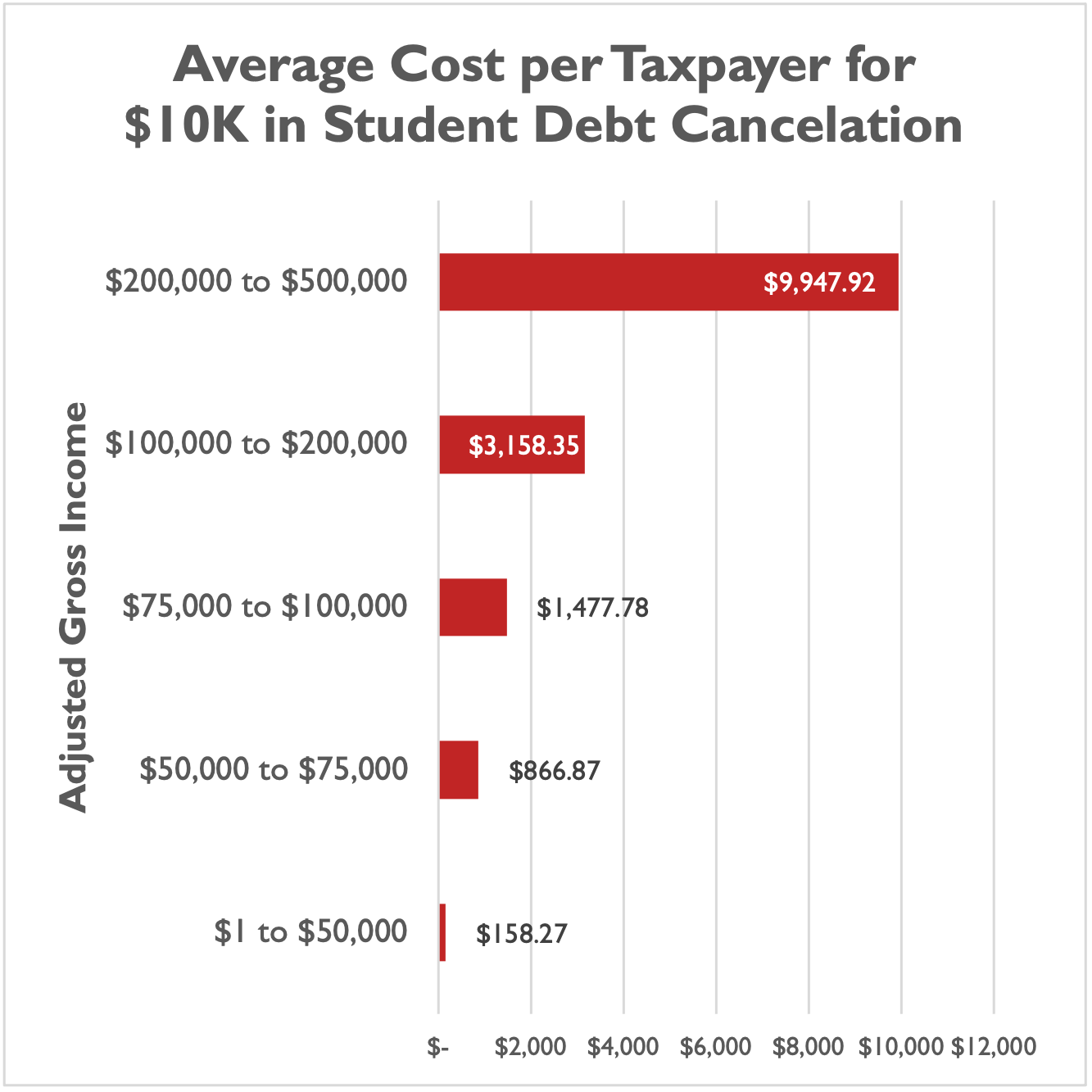

Who Benefits From Student Debt Cancellation

Cost Of Student Debt Cancelation Could Average 2 000 Per Taxpayer Foundation National Taxpayers Union

What Are The Pros And Cons Of Student Loan Forgiveness

Biden S Stimulus Package Makes Student Loan Forgiveness Tax Free Bankrate

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

See How Average Student Loan Debt Has Changed In 10 Years

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

Biden S Student Loan Forgiveness Policy How To Apply Who Qualifies More Abc News

Canceling Student Loan Debt Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Can I Deduct Student Loan Interest College Ave

Student Loans In The United States Wikipedia